The purpose of corporate governance is to cultivate effective, entrepreneurial, and prudent management of the company by describing the processes, structures, and mechanisms that influence the control and direction of the corporation through which the pursuits of the company are set and the standards of attaining those objectives and monitoring performance are committed.

To align the interests of shareholders, management, employees, and society and to create a balance between economic/individual and social/communal goals, it is paramount for organizations to have a robust corporate governance framework. A corporate governance structure should encourage the efficient use of resources and sets accountability for the stewardship of those resources. The activities of corporate executives are crucial to the economic wellbeing of society and it is essential that their actions and decisions are under constant and vigorous public scrutiny.

Our governance approach promotes the ethos of transparency, accountability, and fairness while creating competitive positioning in the market to generate long-term value for the shareholders and foster the stakeholders’ rights and interests. Our corporate governance practices have helped us to create a well-placed decision-making system that enables us to incorporate stakeholder expectations and mitigate risks for efficacious management and supervision of the company’s business.

At Dabur, we make concerted efforts to make our governance practices better every day. We believe sound corporate governance is integral to enhancing and retaining stakeholders’ trust. We are committed to providing long-term value to all our stakeholders. Our corporate Governance goals are centered around conscience, openness, fairness, professionalism, and accountability. To ensure long-term value creation for all our stakeholders, our company has a structured set of policies and procedures in place that keeps the Board of Directors well informed and well equipped while executing their responsibilities and in turn provide management with decisions that have been framed prioritizing stakeholders’ interest. Our strong corporate governance is reflected in our strong market capitalization, regular dividend payments, better credit ratings, and sustainability achievements.

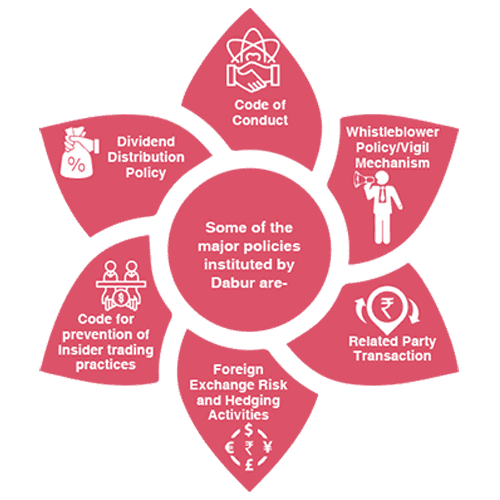

At Dabur, corporate governance is not just adhering to rules and regulations, good corporate governance just makes good sense to us. We believe that good governance is the key to long-term value creation. We are committed to the highest governance standards, anchored on the values of ethical business conduct, accountancy, transparency and responsibility. The company is cognizant that it operates in an extremely dynamic environment. Hence, we review our corporate practices and frameworks continually to ensure that we act in the best interest of our stakeholders. The company has devised an integrated network of policies and procedures to better equip the board in providing a strategic direction to the management. All Directors and employees are bound by our Code of Conduct available at https://www.dabur.com/img/upload-files/165-codeofconductslidesnew.pdf.

Our governance structure strives for balanced objectives that respect all interested parties’ goals, give due weight to all stakeholders, and build a sense of trust and security. We have a clear role for the board and their oversight responsibilities, the management with ethical & high-standard operating principles to create a decision-making process that is transparent, responsible, and fair and creates solid regulatory infrastructure. We strongly believe that equal concern must be provided for all stakeholders and developing governance frameworks that work for the benefit of the board, the managers, shareholders, and stakeholders.

We aim to construct a progressive corporate governance system and an organisational paradigm comprised of an ethical approach toward society.

Integrity and Ethical Behaviour is the fundamental requirement of a qualified and robust board at Dabur. Our Board consist of a diverse group of directors with different skills, backgrounds and perspectives, including independent directors. The Board of directors and executives of the Company are committed to acting with honesty, integrity, and fairness, which are critical to business integrity and maintaining investors’ trust in the Company.

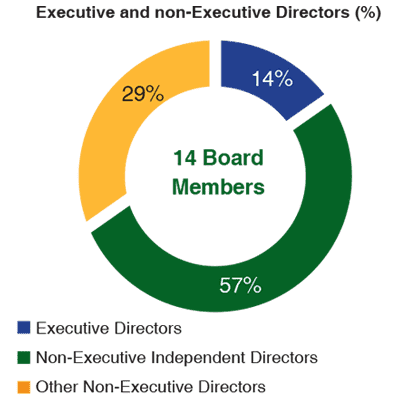

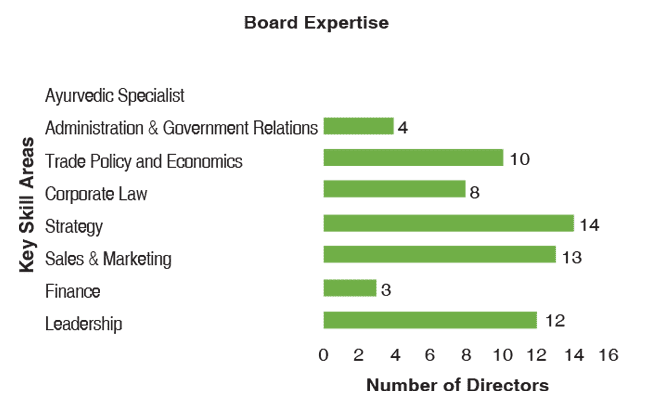

The Board of Directors at Dabur are committed to high standards of corporate governance and consists of experienced professionals having expertise in various practices such as Finance, Strategy, Sales & Marketing, Consulting, Corporate Law, Trade Policy & Economics, Administration and Government Relations. The Company’s Board has an optimum assortment of Executive and Non-Executive Directors and is in line with the provisions of the Act that are applicable and the SEBI Listing Regulations. Keeping the perfect balance of control, more than half of the Board comprises Independent Directors.

The Board also consists of directors who are well versed with our target export markets and hold expertise in commodity procurement; this also includes having a doctorate in Ayurveda. We have a welldefined eligibility criterion for each fundamental skill area of knowledge. The board members’ nomination and selection process details are explained on Page 142 of the Report on Corporate Governance section.

At Dabur, we strive to cultivate a broad spectrum of demographic attributes and characteristics in the boardroom by adopting best global practices for the Board’s effective functioning. For better corporate governance, we believe in having a truly diverse Board that can act as a catalyst for getting high returns for the stakeholders and protecting their interests. Dabur’s Board is an ideal mix of experience, knowledge, innovative thinking and wisdom. The composition of the Board is in conformity with the Companies Act, 2013 and Listing Regulations enjoining specified combination of Executive and Non-Executive Directors with at least one Women Independent Director and not less than fifty percent of the Board comprising of Independent Directors as laid down for a Board chaired by Non-Executive Promoter Director.

As of March 31, 2022, Dabur’s Board consists of 14 members. Besides the Chairman, a Non-Executive Promoter Director, the Board comprises three NonExecutive Promoter Directors, two Executive Directors and eight Non-Executive Independent Directors (including one Woman Independent Director). The profile of Directors can be found on our website at www.dabur.com.

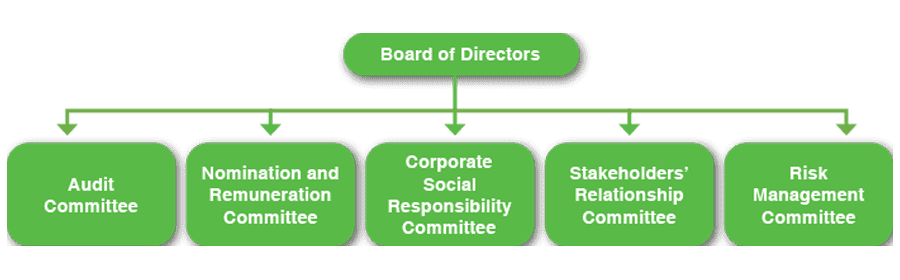

Board and its Committees as required in the context of its business sector and to ensure the highest standards of corporate governance.

The company has a publicly available policy highlighting the diversity requirements of the Board. However, for us, having a diverse board is an essential element of the board formation and structure. We have been constant in maintaining our Board’s diversity and will always strive to have this balance. A diverse board helps us bring in a variety of perspectives parlays into the right guidance, effective decision-making, better risk management ability, and eventually create value in the short, medium, and long term for all the stakeholders.

In deliberation and consultation with the Nomination and Remuneration Committee, the board has created a framework (the Board Evaluation Framework) in accordance with the national regulations to evaluate its performance. The framework is a selfassessment process where several criteria such as Key Performance Indicators (KPIs) related to the performance and execution of specific duties, target achievement, adherence to regulatory compliances, incorporation of social and environmental topics in governance, etc. are set to assess the performance of the board members. This framework is reviewed periodically based on new compliance or for benchmarking with the global standards.

There is a defined process of collection and processing performance and conformance data. Based on the derived data, we analyze and report on the boards’ performance, ensuring the implementation of corrective actions. At Dabur, we have set the performance and conformance targets and a transparent monitoring approach.

Dabur has distinctly defined the roles and responsibilities of its board members. These responsibilities enable the smooth functioning of the Board and aid the members to steer the company towards creating short-, medium-, and long-term values for its stakeholders. Some of the significant duties of the Board include aligning the board actions with the purpose and vision of the company, creating board-level targets: including social and environmental goals, ensuring compliance with statutory regulations, and forming a feedback mechanism for evaluation of the Board’s performance.

The Board determines the goals and policies of the company and is responsible for delivering a long-term sustainable value to the stakeholders through the management of the company’s business and providing strategic guidance within a framework of rewards, incentives and controls. The Board ensures that management strikes the right equilibrium between fostering long-term growth and furnishing short-term objectives.

The Board is also liable for ensuring that management provides assurance of effective and efficient operations, financial controls, law & regulatory compliances and maintains a robust internal control system.

Harbouring their responsibilities, the Board has consideration to what is appropriate for the company’s business and prominence, the materiality of the intrinsic and acquired financial and non-financial risks in the industry, and the proximate risks and opportunities of implementing specific controls.

The Board is also the decision-making body for all other matters of such importance as significance to the Group as a whole because of their strategic, financial or reputational implications or consequences.

The governance policies of our company are well placed to promote ethical business practices. These policies provide a culture of responsible conduct, manage conflict of interest among related parties, and foster an environment for businesses to thrive. Our policies lay down the procedures to address the anti-ethical practices, including the roles and responsibilities of the parties involved. The independence and confidentiality of the mechanisms are duly communicated to the management as well as to all our stakeholders via training and awareness programmes and are regularly revised as per the new regulations or to upgrade them to the global benchmarks.

The company has put in place several committees to oversee the implementation of the company policies. These committees are under the direct prudent control of the Board, which also takes decisions on its terms of reference and composition in a periodic manner. The committees assist the Board in the discharge of its duties and responsibilities.

Our remuneration and incentives policies are linked to value creation in the short, medium and long term. In our remuneration policy for the board of directors, the remuneration committee has ensured that the mix of fixed and variable pay (monetary and non-monetary incentives) meets its needs and strategic objectives.

At Dabur, we strive to ensure that the remuneration offered to our board members is competitive and fair and transparent. As per the company’s remuneration policy, the board members’ compensation consists of sitting fees, salary and prerequisites, performancelinked initiatives, retiral benefits, and commission. For detailed information on the process of determining the remuneration of executives, please refer to the Report on Corporate Governance on Page 142 of this report.

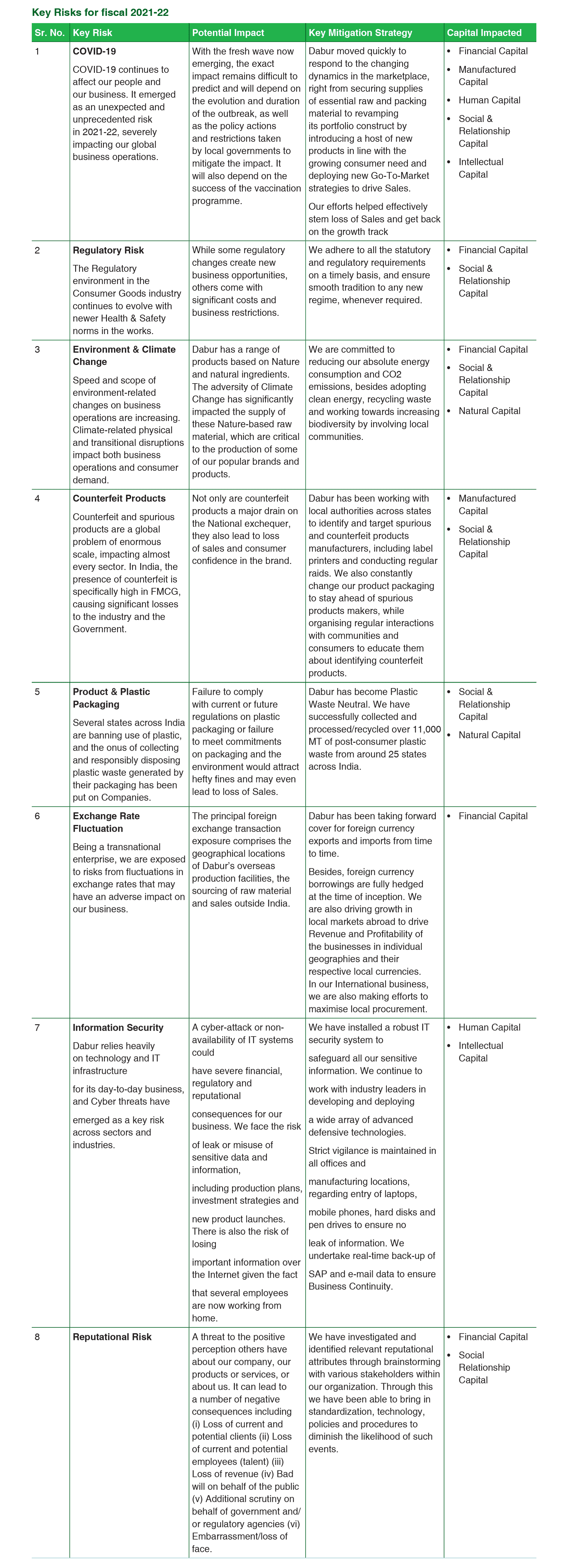

In the Volatile, Uncertain, Complex, Ambiguous (VUCA) environment, it is imperative for the company to have a robust risk management system which helps in hedging the risks to create risk-adjusted returns on value for the stakeholders. Our risk management system is designed to identify the risks, including the ESG topics, that are material to our business and operations and mitigate the negative effects of the same.

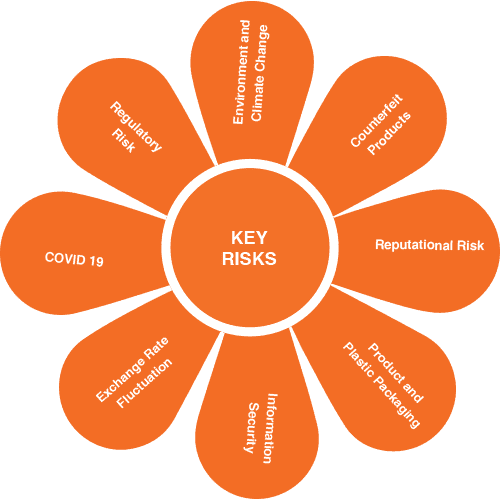

We closely monitor the potential risks and opportunities that arise from political, economic and regulatory environment, exchange rate fluctuations, technology changes, environment and climate change and competition.

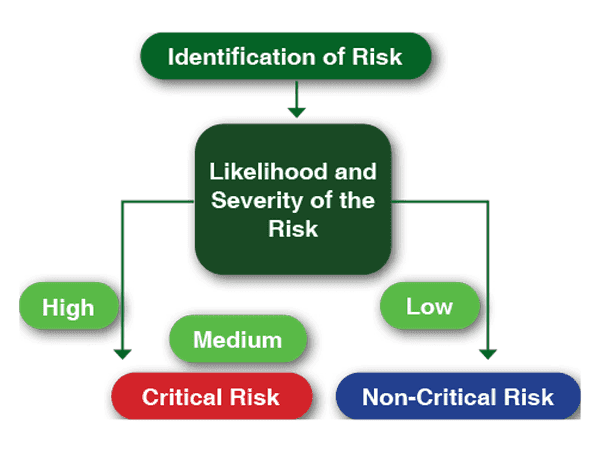

At Dabur, risk management is an integral part of doing business, supported by clear governance. Our Risk management committee is responsible for ensuring the effectiveness of our company’s risk management framework, which helps the organization to respond to identified risks through acceptance, avoidance, transfer and mitigation and also seek opportunities in assorted risk scenarios. The risks are identified based on their likelihood and severity and are categorized into critical and non-critical risks where the high and medium risks are part of critical risks while the low risks are part of non-critical risks

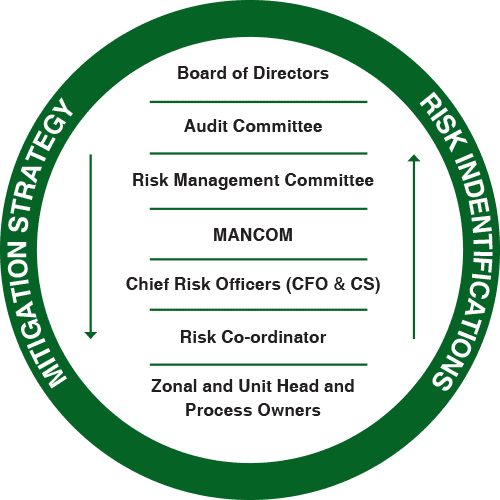

Our business is subject to risks and uncertainties that could have both short-term and long-term implications for the Company. At Dabur, risk assessment is undertaken based on the likelihood of occurrence and possible impact. This assessment metric is pre-defined and approved by the Risk Management Committee. The Committee follows both top-down as well as bottom-up approach. It coordinates between the leadership as well the ground level staff. The committee gathers the stakeholder’s concerns and expectations with respect to the key risks associated with the organization and reports the same to the Board. The process helps the leadership to make informed decisions regarding risk mitigation strategy.

Risk Governance Structure

The COVID-19 outbreak in 2020 and consequent measures undertaken by various governments across the world to contain its spread negatively impacted our business in the initial part of the 2020-21 financial year. Our Company not only managed these risks successfully but also converted them into opportunities and emerged stronger towards the end of the first half of the year. While the extent of the pandemic had subsided as the year went by, the emergence of a second wave is threatening to open up new risks, the extent of which remains uncertain,and it is expected to further affect our way of doing business in the coming fiscal. Following are some of the risks identified by us from a business perspective and our approach towards addressing them. We recognize that this is not a full overview of all risks and uncertainties that may affect the Company. As new risks emerge and existing immaterial risks evolve, timely discovery and accurate evaluation of risks are at the core of Dabur’s risk management system.

Dabur India Ltd has come a long way from where it commenced. What started as a small endeavor to provide better healthcare, in the bylanes of Calcutta has now become one of India’s leading FMCG companies. The 138-year-old legacy of Dabur is a reflection of its strategic business continuity planning.Dabur has successfully met consumer needs for more than a century now. This was possible because of its phenomenal resilience, its ability to change and adapt to the ever-evolving needs of the consumers ahead of others, and its integrated approach to managing risks.

Our relentless focus on enhancing operational efficiency, building a robust ecosystem of supply chains, and strengthening our IT infrastructure has helped us to function with as few disruptions as possible. The onslaught of COVID 19 and its rippling effects on the global economy posed business continuity challenges for many industries and organizations. However, Dabur stood firm against the odds with a strong business continuity plan in action.Our operational efficiency is supported by a multi-phase production facility wherein multiple plants can be used alternatively to ensure seamless production activities even in unprecedented scenarios like plant shutdown or plant failure. External Dependency is one of the major issues posing threat to business continuity.

We, at Dabur by all means, are prepared to overcome the challenges posed by external dependency. Our robust ecosystem of supply chains expands across multiple chains of suppliers thus mitigating the risk of dependency on just a handful for the supply of key raw materials. We select our suppliers and vendors only after conducting risk assessment activities. As a part of incident responsive activities, we focus on finding alternates for all our key input ingredients.

To keep pace with today’s digital-first world, our focus at Dabur has also shifted towards strengthening our IT infrastructure to ensure business continuity.Digitally equipped organizations were the first ones to recover from the effects of COVID, we believe in the power of technology and are committed to leveraging our technical abilities. Our Business Continuity Plan also highlights testing of the restoration plans of IT applications in case of a critical IT application disaster. As suggested in the plan our management has completed testing of action plans for almost all IT applications except a few.

Further, on our road to becoming a better-equipped resilient organization, a business continuity planning study is planned for fiscal 2022-23 to reassess our BCP and make improvements.